Brookfield Global Transition Fund: Accelerating the transition to a net-zero economy

The investment: In 2021, we became founding investment partners in the Brookfield Global Transition Fund, focused on accelerating the transition to net zero.

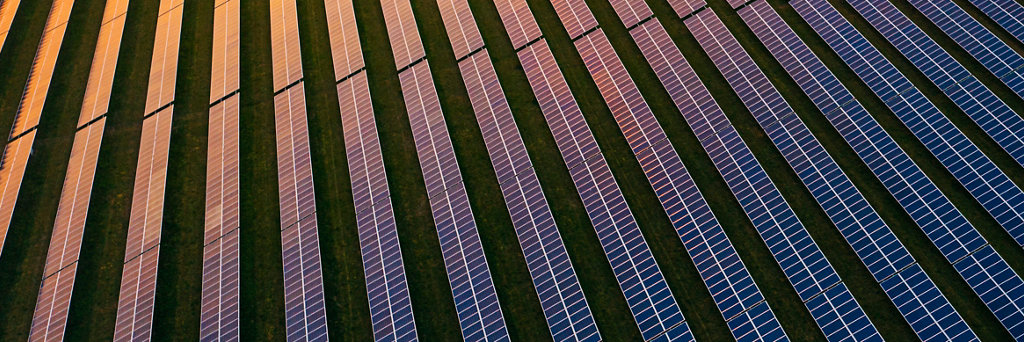

The transition to a net-zero carbon economy will require massive amounts of capital, and extensive collaboration. Significant muscle—both financial and in terms of expertise—will be essential both to scale cleaner energy sources and to help carbon-intensive businesses transform their operations to align with a net-zero future. That’s why we chose to be an anchor investor in the Brookfield Global Transition Fund, the largest fund devoted to accelerating the transition to a net-zero economy.

The Fund targets investment opportunities relating to reducing greenhouse gas emissions and energy consumption, as well as increasing low-carbon energy capacity and supporting sustainable solutions to deliver on the dual objectives of earning strong risk-adjusted returns and generating measurable positive environmental change.

The Fund draws on Brookfield’s deep expertise in renewable power and deep operating capabilities to scale clean energy and invest capital to catalyze the transformation of carbon-intensive businesses. The Fund is co-led by Mark Carney, Brookfield’s Head of Transition Investing and the UN’s Special Envoy on Climate Action and Finance, one of the world’s leading voices on how the private sector can be mobilized to help the energy transition. The Fund, which has already raised US$7 billion and has a hard cap of US$12.5 billion, has attracted other leading global institutional investors. Ontario Teachers’ is proud to join forces with Brookfield and these institutions to work for change.

For Ontario Teachers’, participating in the Brookfield Global Transition Fund reflects our commitment to providing retirement security for our members while also helping to make the world a better place. We believe our members’ financial security is closely tied to how the planet is doing. As part of that strategy, we’re committed to achieving net-zero greenhouse-gas emissions by 2050. We’ve also set industry-leading interim net-zero targets that hold us accountable to catalyzing change, and have outlined the plan we will execute to significantly reduce emissions. This includes scaling green investments and helping portfolio companies decarbonize their operations.

“We are thrilled to have this group of strategic, like-minded partners investing alongside us in the Brookfield Global Transition Fund. We all believe that private capital has a critical role to play in addressing climate change. Our collaboration reflects our shared determination to mobilize the resources of the private sector in delivering the innovative and impactful solutions required to effect change. We look forward to working closely with these and other investors in the Fund to deliver a positive societal impact while generating attractive returns.”

Bruce Flatt, CEO

Brookfield Asset Management